SavvyMoney

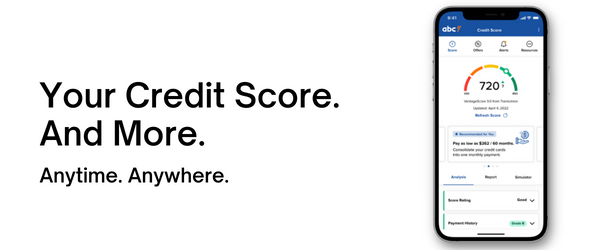

Your Credit Score. And More. Anytime. Anywhere.

At FSFCU, our mission is to help members reach financial success by offering the latest and most valuable financial tools. That’s why we’re excited to introduce SavvyMoney, available through our Online and Mobile Banking. With SavvyMoney, members can check their credit score anytime, anywhere—from their phone or computer.

Best of all, it’s free! Use it to track your credit report and take steps toward building a stronger credit score.

BENEFITS OF SavvyMoney:

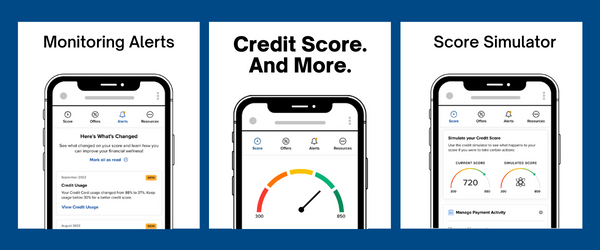

Daily Access to your Credit Score

Real-Time Credit Monitoring Alerts

Credit Score Simulator

Personalized Credit Report

Special Credit Offers

And More!

SavvyMoney Member FAQ

A: SavvyMoney is a comprehensive platform that provides members with free and ongoing access to their latest credit scores and reports, real-time credit monitoring, and savings opportunities on existing and new loans and credit cards – all through their online and mobile banking.

A: SavvyMoney Credit Report provides members with all the information they would find on a credit file including a list of current or previous loans and accounts and credit inquiries. Members can see details on their payment history, credit utilization, and the public records that show up on their accounts. Like Credit Score, when a member checks their credit report, there’s no impact on their credit score.

A: Score Simulator is an interactive tool that allows members to see how hypothetical actions may affect their credit score, including things like paying off a credit card balance or applying for a loan. Just like checking their credit score through SavvyMoney, using the simulator does not affect the member's credit score.

A: No. SavvyMoney is entirely free to the member, and no credit card information is required to register.

A: Every 7 days scores are updated and displayed in digital banking. Members can also refresh their score and full report every 24 hours by clicking “Refresh Score” and navigating to the detailed Credit Score Dashboard within digital banking.

A: SavvyMoney pulls members’ credit profiles from TransUnion, one of the three major credit reporting bureaus, and uses VantageScore 3.0, a credit scoring model developed collaboratively by the three major credit bureaus, to make score information more uniform between the different bureaus and provide members with a better picture of their credit health. Key factors that drive the score are the same.

A: There are three major credit reporting bureaus—Equifax, Experian, and Transunion—and two scoring models—FICO or VantageScore—that determine credit scores. Financial institutions use different bureaus and scoring models. Over 200 factors of a credit report may be considered when calculating a score and each model may weigh credit factors differently, so no scoring model is completely identical although there are similarities.

SavvyMoney Credit Scores are represented in ranges, shown as follows:

- 780–850 – “Excellent” – very healthy credit history, lowest loan/credit card rates.

- 660–779 – “Good” – good credit with minor issues, still favorable rates.

- 600–659 – “Fair” – limited borrowing opportunities, higher loan rates.

- 500–599 – “Unfavorable” – serious credit issues or new to credit, higher loan rates.

- Below 500 – “Deficient” – significant defaults/negative marks, difficult to get loans.

If you live, work, worship or attend school in these counties, you may be eligible for membership:

Oklahoma Counties:Comanche, Caddo, Canadian, Cleveland, Cotton, Garvin, Grady, Jefferson, Kiowa, McClain, Oklahoma, Stephens, Tillman, and Washita

Texas Counties: Archer, Haskell, Montague, Shackleford, Throckmorton, Wichita, and Wilbarger.

Become a member today and start experiencing the credit union difference.

For information regarding fees, please refer to our Fee Schedule

Once you have established an account, you can take advantage of these beneficial offers and services:

Overdraft Privilege |

Online & Mobile Banking |

Special Offers on Loans

Credit Cards with Rewards |

ATM/Debit Cards |

Shared Branching