The best ways to budget your money

Become a better money manager TODAY!

Budgeting is the essential key to financial health. If you don’t have a physical plan that demonstrates where your money is going, you’ll end up wondering what you spent it on.

In this blog post, we’ll take a deeper look at the best ways to budget your money and stick to the plan.

Accounting for every dollar you earn

The first step to budgeting is determining how much money you actually have to spend. Consider your paycheck after taxes are taken out — aka your "net income.” Budget all the way down to zero, meaning, give every dollar you earn a purpose.

Then determine which categories your paycheck will divide into. Many people call these “sinking funds,” or money set aside for specific expenses.

People normally split these expenses into needs, wants, and savings. Half (50%) of your net income should go to needs. Yes — that’s our least favorite category, too.

The most common pay frequencies are weekly, bi-weekly (every other week), semi-monthly (two times a month), and monthly.

Here are a few examples of needs to consider when you receive your paycheck:

Housing: Your monthly rent or mortgage payment

Personal expenses: Gas, groceries, household items (toilet paper, cleaning supplies, etc.)

Debt payments: Credit cards, student loans, personal loans, etc.

Depending on how often you get paid, it’s a good idea to write down each bill in order of its due date. This way you’re always prepared to divide and distribute your money. Every dollar is accounted for!

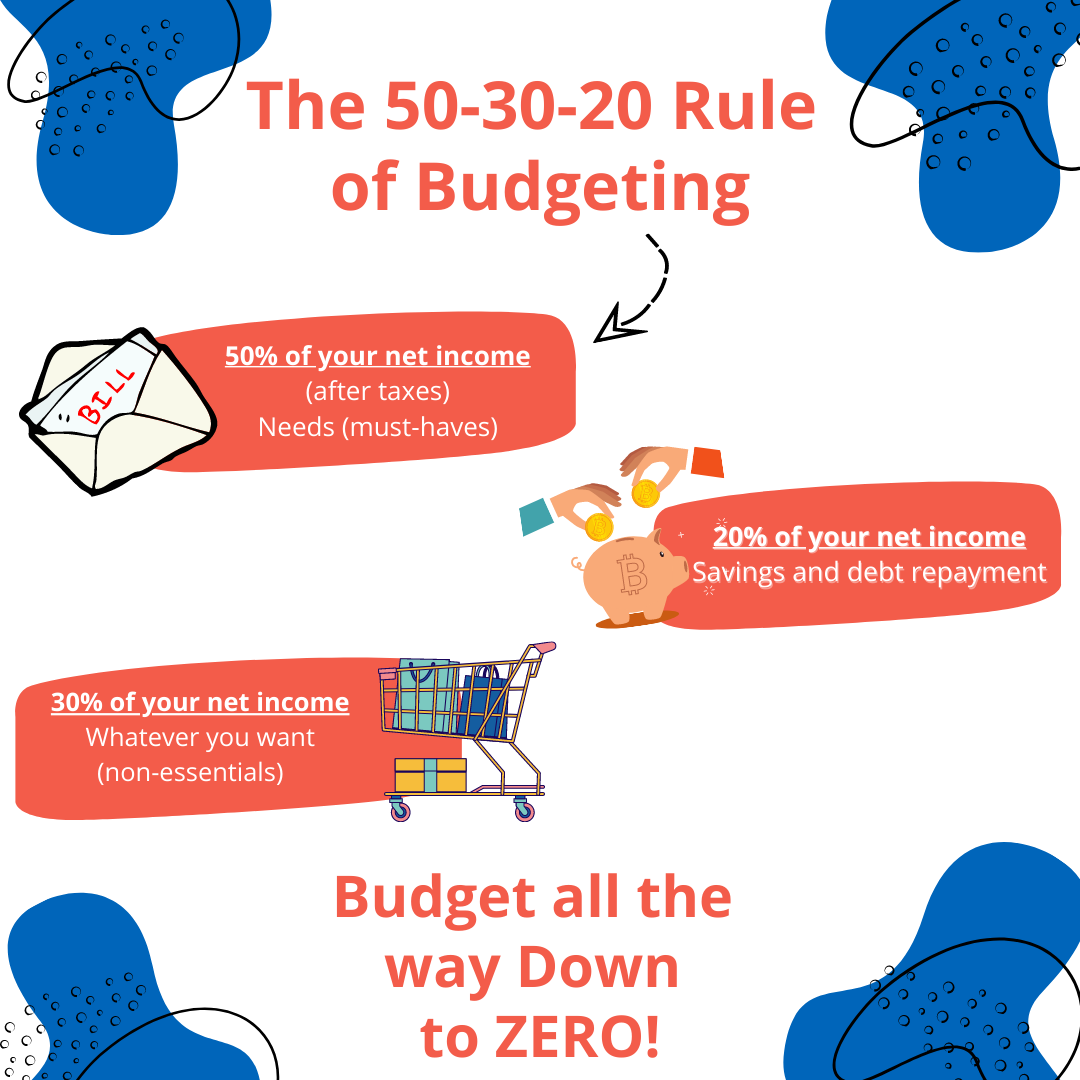

The 50-30-20 rule of saving money

Ideally, we want to aim for 30% of your remaining income to go towards savings. The other 20% can go towards “fun” money (vacations, shopping, eating out, etc.). We know this isn’t always realistic, however.

If you save 20% of your income and spend 30% on non-essentials, you’ll be on the right track!

Dividing your paycheck into checking and savings accounts

To easily visualize your money in these categories, we suggest opening up accounts to help you see exactly where your dollars are going. Consider using two different checking accounts — one to pay your bills each month, and the other to pay for personal expenses like gas and groceries.

DEBIT PLUS Checking Account

Earn cashback and refunds on every debit card purchase when you open a DEBIT PLUS Checking Account at Fort Sill Federal Credit Union.

When your paycheck arrives, deposit your money for bills and personal expenses into their respective checking accounts. You are now holding yourself accountable for every dollar you earn! There may be months where you have money leftover, however.

Remember, the goal of sticking to a budget is to find a place for EVERY dollar (budget down to ZERO).

Here are three options for what to do with any leftover money you have:

Deposit leftover money into a savings account

Carry it over to the next month and put it towards a bill

Create a new sinking fund (new shoes, extra debt payment, etc.)

Building your emergency savings fund

The rule of thumb with savings accounts is to have enough money set aside to support yourself for 3-6 months in case of emergency. The COVID-19 pandemic is proof that emergency funds are extremely important. They’re not always fun to save for, but they’re awfully essential.

Designate one savings account to strictly just emergency funds. The pattern looks the same, but emergency savings may look different for everyone. Pet owners may pull from their emergency funds for unexpected vet bills.

You may pull from your emergency savings to pay for new car tires if you get a flat (fingers crossed). Either way, avoid using this account to upgrade your closet or buy a new pair of golf clubs. Don’t worry — that’s what the last category is for.

Work hard, SAVE hard, play hard

The last rule to budgeting is to leave room for fun! You work hard to earn your money so that you can not only live but enjoy life! Look at your remaining 20-30% each month and decide how much you can spend on vacations, shopping, concerts, etc.

Dedicate a savings account to these types of expenses. Vacation accounts are perfect for putting away enough “fun” money in order to cover travel expenses like hotels, delicious meals, and exciting excursions.

Christmas Club Accounts

Looking to take the strain off your wallet during the holiday season? Avoid last-minute penny-pinching and holiday shopping when you open a Christmas Club Account at FSFCU. Get started with only $5.00 and grow your holiday savings from there.

Become a member and learn how to open the ideal savings account for your next vacation or shopping spree. Don’t forget your budget! That’s the credit union difference.